tax loss harvesting rules

Ordering tax forms instructions and publications. Many people forget about state taxes when planning quarterly estimated tax payments.

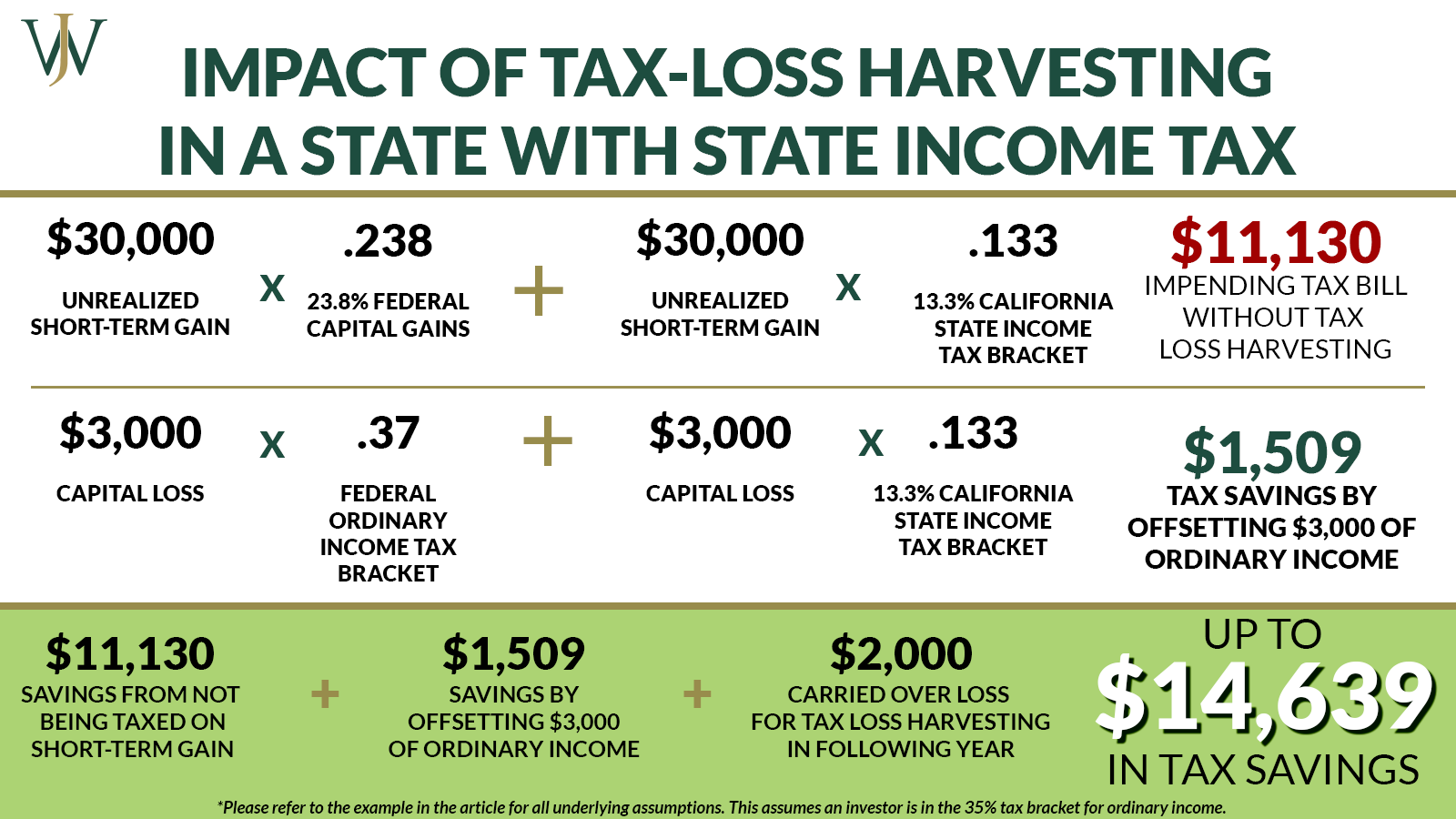

Calculating The True Benefits Of Tax Loss Harvesting Tlh

However the following are the most common working remotely tax implications to know about.

. How to Avoid Violating Wash Sale Rules When Realizing Tax Losses. To claim a loss for tax purposes. There are rules to keep in mind while.

Each city and state has its own rules and we cant cover them all here. If you work in the same state as your employer. Once losses exceed gains you can use the.

These gain and loss rules apply primarily to publicly traded investments such as stocks bonds mutual funds and in some cases real estate holdings. For the deductible part of self-employed health insurance. Go to IRSgov.

If your net capital loss is more than. What it is. Capital Gains Tax 101.

To recap when investors sell a stock for a profit they must pay federal capital gains tax which has two rates. Claim the loss on line 7 of your Form 1040 or Form 1040-SR. For this reason if you engaged in tax loss harvesting you should consider purchasing a different replacement security.

Be aware there are rules regarding tax-loss harvesting that can nullify their value such as the rules on wash sales of securities. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their ordinary income. Tax-loss harvesting is when you realize a capital loss on purpose so that you can use it to offset gains and income in the future.

The strategy known as tax-loss harvesting allows you to sell declining assets from your brokerage account and use the losses to reduce other profits. If you find yourself making estimated payments to the IRS then you may also need to make estimated tax payments to the state. This rule prohibits you from selling an investment to book a capital loss to reduce your tax bill and immediately repurchasing it.

Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins. A wash sale is one of the key pitfalls to avoid when trying to take advantage of tax-loss harvesting to reduce your taxes and in falling markets such as in 2022 it can be valuable to make sure. If a wash sale occurs you cannot use any of the capital loss to reduce your taxes.

Tax-loss harvesting is a common strategy for reducing capital gains taxes. Anyone with capital losses in a given tax year. Tax Rules for Bitcoin and Others.

Basic Rules Investors and Others Need to Know. Wash sale rules prevent investors from harvesting capital losses and immediately repurchasing the same asset. Additional Rules and Changes.

In fact by keeping careful track of your returns you can potentially save money using a method called tax loss harvesting. Crypto Taxes in 2022. Capital Gains Tax 101.

The special rules in section 172 permitting 5-year carrybacks for 2018 2019 and 2020 net operating losses NOLs added by the Coronavirus Aid Relief and Economic Security Act CARES Act of 2020 have expired. One of the most important rules surrounding tax-loss harvesting is the wash sale rule. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total net loss shown on line 16 of Schedule D Form 1040.

Avoiding a Big Tax Bill on Rental Real Estate Gains. Investors use of tax-loss harvesting involves knowing both the positives and the negatives. Long-term if you held the stock for at least a year and a day 0 15 or 20.

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Reap The Benefits Of Tax Loss Harvesting

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Everything You Should Know

What Is Tax Loss Harvesting Ticker Tape

Year Round Tax Loss Harvesting Benefits Onebite

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

How To Choose The Best State To Retire In

Turning Losses Into Tax Advantages

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Napkin Finance

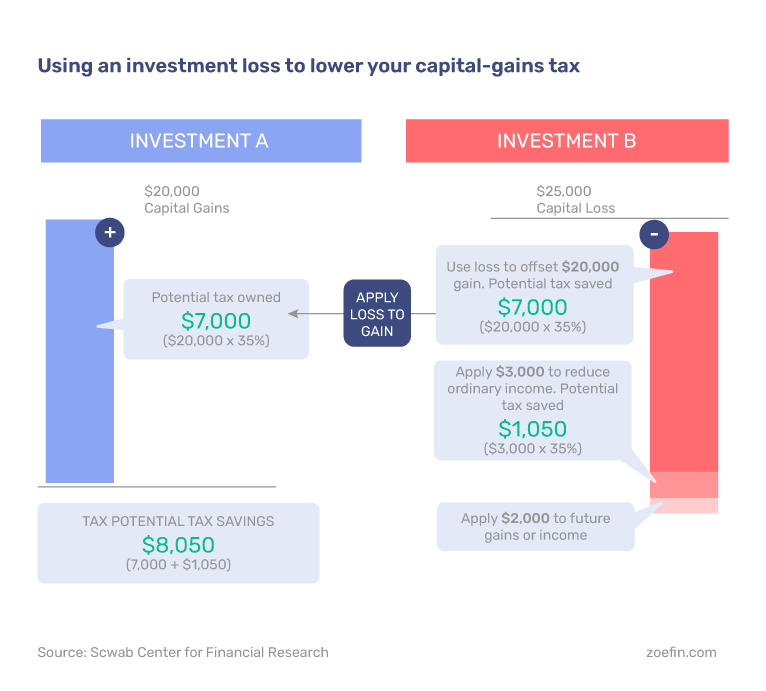

Do S And Don Ts Of Tax Loss Harvesting Zoe

Turning Losses Into Tax Advantages

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management